mobile al sales tax registration

What is the sales tax rate in Mobile Alabama. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ad New State Sales Tax Registration Application Exemption.

. See information regarding business licenses here. Ad New State Sales Tax Registration Application Exemption. Easily manage tax compliance for the most complex states product types and scenarios.

Chapter 34 - LICENSES AND TAXATION. Policemen and Firefighters Pension and. The calculator then displays a 5 auto tax rate.

Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions. Seller Use Tax Tax Form 13. Easily manage tax compliance for the most complex states product types and scenarios.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. The minimum combined 2022 sales tax rate for mobile alabama is. Overview Employment Chamber of Commerce Business Licenses Alarm Permits Registration.

Sales Tax Form 12. Alabama Sales Tax Registration registration application for new businesses. The minimum combined 2022 sales tax rate for mobile county alabama is 10.

Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions. Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a.

Alabama Sales Tax Registration registration application for new businesses. A mail fee of. The minimum combined 2022 sales tax rate for.

Fill out one form choose the states you sell to and let us do the heavy lifting. Ad Offload the tedius tasks of registering in mulitple jurisdictions to Avalara. Fill out one form choose the states you sell to and let us do the heavy lifting.

Online Filing Using ONE SPOT-MAT. To determine the sales tax on a. The local tax is due monthly with returns and remittances to be filed on or before the 20th day.

If you have questions please contact our. Mobile Alabama - Code of Ordinances. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

The current total local sales tax rate in Mobile AL is 10000. The Revenue Department administers the Privilege License Tax. Ad Offload the tedius tasks of registering in mulitple jurisdictions to Avalara.

Licenses And Taxes City Of Mobile

Sales Guide Tax For Digital Goods

Home Prattville Alabama Prattvilleal Gov Official Site Of The City Of Prattville

Alabama Severe Weather Awareness Week

Self Employed Online Tax Filing And E File Tax Prep H R Block

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog

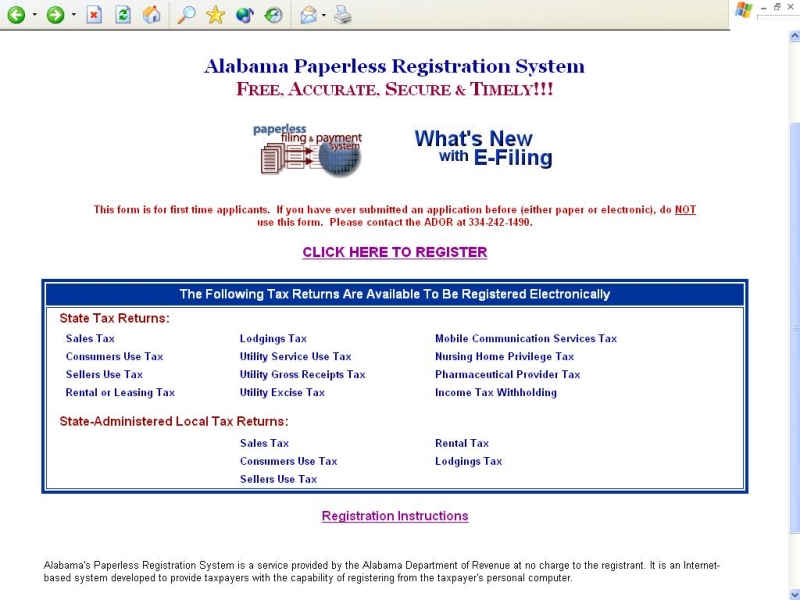

Alabama Set Up Your Online Filing Account Taxjar Support

Vertex Energy To Acquire Shell S Mobile Alabama Refinery Reuters

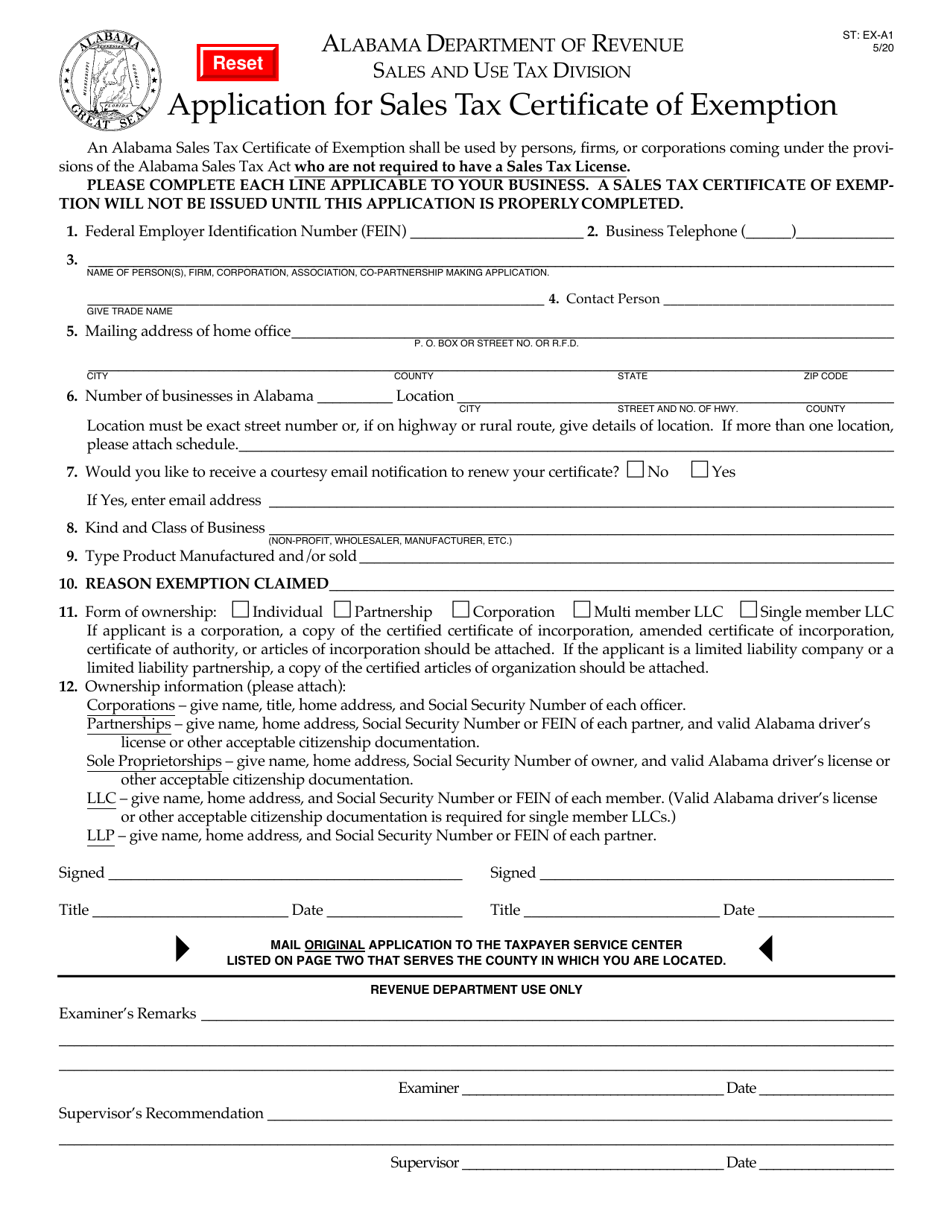

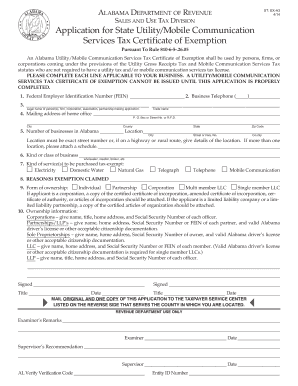

Form St Ex A1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller

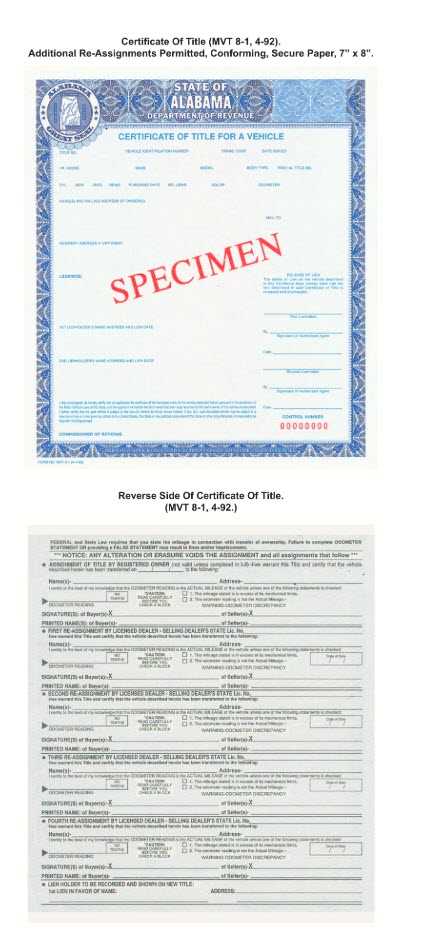

Alabama Tax Title Registration Requirements Process Street

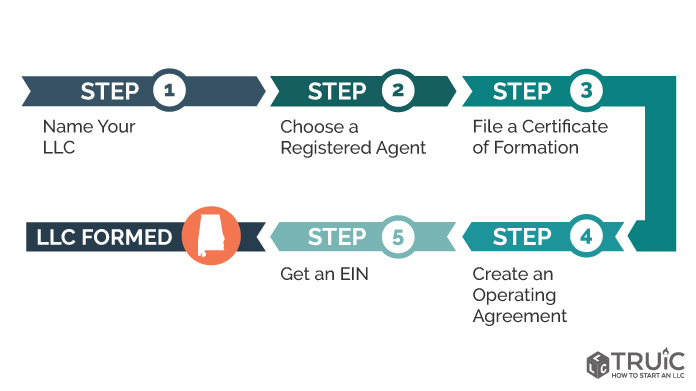

Llc In Alabama How To Start An Llc In Alabama Truic

Sales Tax Holidays Politically Expedient But Poor Tax Policy

How To Register For A Sales Tax Permit In Alabama Taxvalet

Fillable Online Revenue Alabama Alabama Department Of Revenue Renew State Utilitymobile Communication Services Tax Certificate Exemption Form Fax Email Print Pdffiller